GST LAW – TECHNICAL & ANALYTICAL COURSE

₹10,000.00

Speaker : CA SACHIN JAIN {B.COM(hons.),LLB,ACA,CS,DISA}

FEES : 10,000 + GST @18% (INCLUDING THE COST OF COMPLETE PHYSICAL MATERIAL)

VAILIDITY OF RECORDING : 2 MONTH

Out of stock

GST LAW – TECHNICAL & ANALYTICAL COURSE

(ONE COURSE – TO FINALIZE EVERYTHING IN GST)

COVERING:

✒️ Complete Updated GST Law – Deep Analysis : In this Segment we are going to cover complete detailed analysis of GST Law from basic level till advanced level. We will cover each and every provision of GST Law in a very simplified language with live practical examples.

✒️ Notification & Circular – Analysis : In this segment we will cover complete analysis of each and every circular and notification of GST Law in a very simplified language with complete practical aspects. Will cover notification and circulars since implementation of GST Law.

✒️ Important Judgements – Analysis : In this segment we are going to cover land marking judgements under GST Law. Will cover Judgements is a very simplified way with practical applicability. Will also going to cover the practical applicability of judgements in our cases and how one can utilize the same while handling the litigations.

✒️ Practical Return Filing and checking – Complete Practical Guide : In this segment will cover filing and preparation of each and every return under GST Law with Live Data base. Will also going to cover the techniques to check the various returns under GST. Also covering the techniques to track the compliances.

✒️ litigation handling techniques : In this segment we are going to cover the complete guide to handle various litigations under GST with various drafting formats and filing of appeal under GST. Will also going to cover the implication of provisions of law and various judgements during litigations.

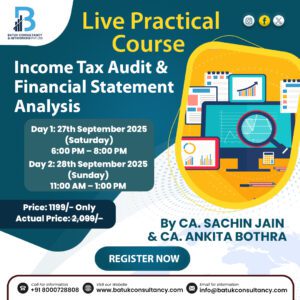

SCHEDULE:

5th & 6th of August – 8:00 AM – 12:30 PM

12th & 13th of August – 8:00 AM – 12:30 PM

19th & 20th of August – 8:00 AM – 12:30 PM

26th & 27th of August – 8:00 AM -12:30 PM

2nd & 3rd of September – 8:00 AM – 12:30 PM

Reviews

There are no reviews yet.