GST Audits Decoded: Strategies for Officers and Staff

₹495.00 Original price was: ₹495.00.₹199.00Current price is: ₹199.00.

SIMPLIFIED GST GUIDE FOR PROFESSIONALS

₹1,499.00 Original price was: ₹1,499.00.₹1,299.00Current price is: ₹1,299.00.

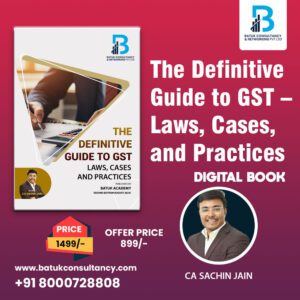

ABOUT AUTHOR : CA SACHIN JAIN

{B.COM(hons.),LLB,ACA,CS,DISA}

.PRICE OF BOOK MRP : – ₹ 1499

DISCOUNTED PRICE – ₹ 1299 (Including GST and Postal Charges)

Out of stock

SKU:

BATUK-B-SGG–FP

Category: Books

Description

This book is designed for Professionals as well as for GST Officers & Staff. This book is a complete guide for Them. In this book we had covered complete GST Law in a very simplified way for better understanding. Also covered various examples for your better understanding and preparation for exams. The content of this book is as under :

- GST – Introduction

- Supply under GST

- Charge of GST

- Exemptions under GST

- Place of supply

- Time of Supply

- Value of Supply

- Input tax Credit

- Registrations

- Tax Invoice

- Credit and Debit Notes

- Accounts & Records

- E- Way Bill

- Payment of Taxes

- Returns under GST

- Import and Exports

- Refunds under GST

- Job Work under GST

- Audit & Assessment

- Inspection under GST

- Search, Seizure and Arrest

- Demand & Recovery under GST

- Liability to pay in certain cases

- Offences & Penalties

- Appeal & Revision – under GST

- Advance Ruling

Reviews (0)

Be the first to review “SIMPLIFIED GST GUIDE FOR PROFESSIONALS” Cancel reply

Related products

GST Audits Decoded: Strategies for Officers and Staff

India’s First Comic Book on GST – “GST Pe Charcha – The Comic Way” By CA Sachin Jain

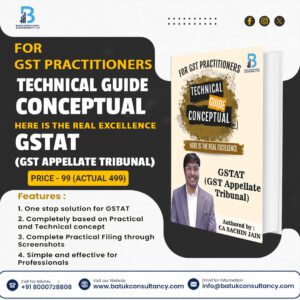

TECHNICAL GUIDE CONCEPTUAL – GSTAT (GST Appellate Tribunal) – Ebook

Technical Guide to GSTR-9 & 9C – E Book

Rated 5.00 out of 5

Reviews

There are no reviews yet.