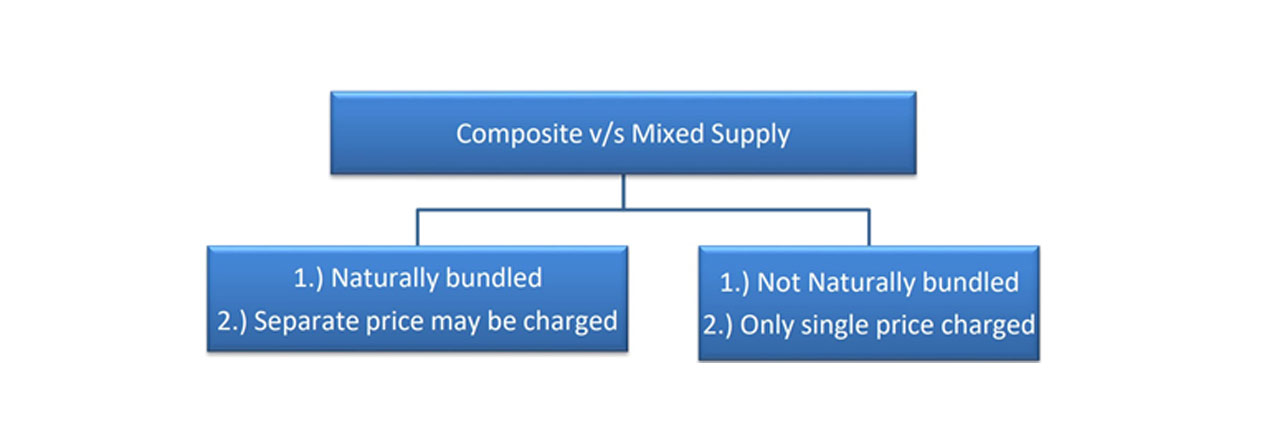

Difference between Composite and Mixed Supply

Are you Still Confused to Identify the Difference between Composite and Mixed Supply ? – Then This Blog if for you

Let’s Understand the Provision First :

SECTION 8: Tax liability on composite and mixed supplies.—

The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:—

- a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

- a mixed supply comprising two or more supplies shall be treated as a supply of that particular supply which attracts the highest rate of

EXPLANATION

- Composite supply: Two or more supplies and both are naturally bundled, supplied in conjunction with each other in the ordinary course of business, one of which is principal

- Principal Supply: it is the predominant part of composite supply, ancillary for

- Mixed Supply: This is not a composite There is two or more individual supplies of goods or services, Supplied for a single price.

Examples:

- Bus body Building – In this work, supply of parts of bus body and fitting thereof shall be included. Here principal supply is body parts and fitting is ancillary part of composite supply (PARAS MOTOR INDUSTRIES – AAR HARYANA).

- SUPPLY ERECTION AND ASSEMBLY OF AIR CONDITIONING PLANT IS COMPOSITE SUPPLY and here principal supply is Supply of air conditioner hence rate of GST will be 28% as applicable on

- Example: Mr. Mohit go for servicing of his CAR. Mechanic had done the servicing of car and he has also used certain goods for servicing the car and he has mentioned both the element in invoice separately hence different GST rate shall be charged on both the

MEANING OF NATURALLY BUNDLED

Depend of frequent practices of business. Certain indications are also listed here in under for reference: –

- Perception of the If large number of customer want that this should be provided in a pack then it will be naturally bundled.

- Nature.

- Majority in the market (i.e. What treatment is to be done by majority of service provider ?)

EXAMPLES OF COMPOSITE SUPPLY

- Supply of goods with

- Supply of desktop computer with CPU, Monitor, Keyboard and mouse is single (AAR – TAMILNADU)

- Palash has taken a house on rent. with rent, he is required to pay the amount of electricity and water charges. Then this is treated as composite supply of services. Hence GST shall be charged @ applicable on rent (i.e. principal supply) (AAR – MAHARASTRA).

- Mradul has purchased a medical equipment along with the equipment he had also received a medical instrument for buying a particular quantity of product hence this is a composite supply where supply of medical equipment is a principal supply.(SANDVIK ASIA (P) LTD. AAR – RAJASTHAN)

- After sales service with spare parts, Batteries

- Sale, purchase and transfer of secured debt is as good as transfer of money hence not subject to GST but GST shall be charged on service fees charged on such

- Beneficial Interest in movable property which is not in possession is defined as actionable claim and hence subject to

- Securities are neither supply of goods nor supply of service hence not liable for GST. But transaction charges regarding issuance of Securities are subject to

- Dividend income and also profit on sale of shares are not subject to GST because this income is due to transaction in securities and when securities itself are not taxable then income from securities are also not taxable.(These are not exempt Supply)