Foreign Subsidiary Company and its Compliances

Definition of Foreign Subsidiary Company :

A foreign subsidiary company is any company, where 50% or more of its equity shares are owned by a company that is incorporated in another foreign nation. The said foreign company in such a case is called the holding company or the parent company.

For a company to be a foreign subsidiary company in India, the company itself must be incorporated in India. It does not matter which country the parent company is incorporated in.

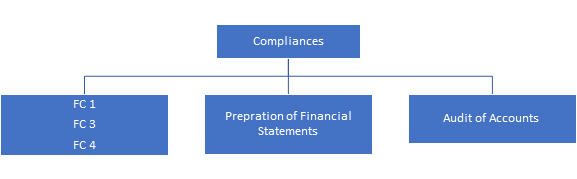

Compliances Applicable for Foreign Subsidiary Company :

Compliances are based on many aspects of the company. One must understand what all compliances are supposed to be met according to the type of company that is incorporated, the industry of operations, annual turnover, number of employees. A foreign company is defined under section 2(42) of the Companies Act, 2013, such a company must follow regulations and rules established under multiple legislations and orders such as:

Companies Act, 2013 – Income Tax Act, 1961

GST, 2017 – SEBI rules and regulations

FEMA (Foreign Exchange Management Act), 1999 – RBI compliances etc.

Essential Compliances

The following are the more important compliances that have to be met by the foreign subsidiary company as per Section 380 and 381 of the Companies Act, 2013:

Form FC-1 under Section 380: The FC-1 form is important as the form has to be filed within thirty days of the incorporation of the subsidiary company in India. The form is not to be submitted alone, it must be accompanied by the required files, certifications etc. from other regulatory bodies in India such as the RBI.

Form FC-3 under Section 380: This form needs to be submitted to the respective Registrar of Companies (ROC) depending upon where the company is incorporated in India. The form must contain the details of the areas where the business is going to conduct operations as well as the financial records of the company.

Form FC-4 under Section 381: This form is concerned with the annual returns of the company. It has to be filed within sixty days from the end of the preceding financial year.

Financial statements: The company has to submit financial statements on its Indian business and operations. This must be submitted within six months of the end of the financial year. They must contain: – Statements on the transfer of funds – Statements of earnings repatriated – Statements on related party transactions such as statements on sales, transfer of property, purchases etc.

Audit of accounts: All accounts of the foreign subsidiary company must be audited by a Practising Chartered Accountant. These accounts should be properly arranged and made available by the company for the audit.

Authentication and translation of documents: All the documents that are submitted by the company to the ROC must be validated by a practising lawyer in India. These documents also need to be translated into English before its validation and submission.