MSME (MICRO, SMALL, AND MEDIUM ENTERPRISES)

Definition:

- MSMEs are small-sized business enterprises defined in terms of their investment. According to the provisions of the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, these enterprises are classified into three categories:

- Micro Enterprises: Where the investment in plant and machinery or equipment does not exceed one crore rupees, and turnover does not exceed five crore rupees.

- Small Enterprises: Where the investment in plant and machinery or equipment does not exceed ten crore rupees, and turnover does not exceed fifty crore rupees.

- Medium Enterprises: Where the investment in plant and machinery or equipment does not exceed fifty crore rupees, and turnover does not exceed two hundred and fifty crore rupees

Udyam registration is the process for title MSME

Udyam Registration:

- The Udyam Registration process is free, paperless, and based on self-declaration.

- No documents or proof are required to be uploaded for registering an MSME. Only your Aadhaar Number will suffice.

- The registration process is fully online and integrated with Income Tax and GSTIN systems.

- Having a PAN and GSTIN (as per the applicability of the CGST Act 2017) is required for Udyam Registration since April 1, 2021.

- If you already have EM-II, UAM registration, or any other registration issued by any authority under the Ministry of MSME, you’ll need to re-register.

- Remember, no enterprise should file more than one Udyam Registration

Here Aadhar number of applicant or entrepreneur (director or managing director in Case of company or partner in case of firm) needed.

Benefits for MSME:

Bank Loans (Collateral Free):

- The Government of India has made collateral-free credit available to all small and micro-business sectors.

- This initiative guarantees funds to micro and small sector enterprises.

- Both old and new enterprises can claim the benefits of this scheme

Subsidy on Patent Registration

- MSMEs registered with the MSME ministry can benefit from a 50% subsidy on their patent registration fees.

- This encourages small businesses and firms to keep innovating and working on new projects and technologies

Industrial Promotion Subsidy:

- MSMEs may be eligible for subsidies related to industrial promotion and development.

- These subsidies can help reduce operational costs and promote growth

Timely Payments:

- MSMEs can benefit from timely payments through government initiatives, like implementation of 43b(h) under income tax act, 1961.

- Ensuring prompt payments helps improve cash flow and overall business stability.

Free ISO Certification:

- MSMEs can avail free ISO certification to enhance their credibility and competitiveness.

- ISO certification demonstrates adherence to quality standards and boosts customer trust.

Section 43b(h) of income tax act, 1961

Section 43B (h) of the Income Tax Act pertains to payments owed to Micro, Small, and Medium Enterprises (MSMEs) for goods supplied or services rendered. Let’s delve into the details:

1. Applicability:

- This clause applies when an enterprise purchases goods or avails services from an MSME registered under the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006.

- Notably, the buyer’s registration under the MSMED Act is not mandatory

- The effective date for this clause is April 1, 2024

2. New MSME 45 Days Payment Rule

- Section 43B (h) stipulates that any sum payable by the assessee to an MSME beyond the time limit set in Section 15 of the MSMED Act, 2006, is eligible for deduction i.e. 45 days maximum in case of written agreement, in absence of written agreement 15 days.

- Here seller is registered under MSME Act which includes manufacturer, service provider but trader is register under MSME only for benefit of priority sector lending so provision of 43b(h) is not applicable to traders.

- The deduction is applicable in the previous year when the sum is actually paid.

- In other words, if an enterprise delays payment to an MSME beyond the stipulated deadlines, it won’t be considered a deductible expense in the year the liability was incurred.

Effects of Section 43b(h) of income tax act

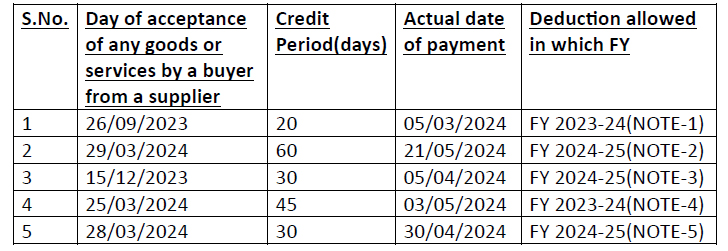

NOTE-1: payment is beyond credit period but upto closing financial year than deduction of expenses allowed in same financial year but interest on delayed payment to msme is not allowed under income tax act, 1961.

NOTE-2: payment is upto credit period but maximum credit period is allowed under msme act is 45 days so beyond 45 days as well as payment day fall under next financial year so disallow for 2023-24 as expenses but allow in 2024-25.

NOTE-3: payment is beyond credit period and after closing financial year so expenses allowed in 2024-24

NOTE-4: payment is upto credit period and 45 days maximum criteria also fulfil.

NOTE-5: payment is beyond credit period; 45 days criteria is maximum if credit period is 30 days so 30 days is considering for allowing expense u/s 43b(h).

IMPORTANT POINTS

- Section 43b(h) is applicable on micro and small enterprises not on medium enterprises

- Assessee (buyers) whom income is calculated under presumptive taxation scheme i.e. 44AD, 44ADA, 44AE are outside in purview of 43b(h) of income tax act,1961.

- Only audited under 44ab assessee(buyers) whom section 43b(h) will applicable.