Are you Confused to decide Value of Supply

Are you Confused to decide Value of Supply ? – Read our article for deep Analysis

SECTION 15(1): The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

Explanation: Two conditions are most important:

- Supplier and recipient are not related

- price is the sole consideration for the

{Example: Mr. Rakesh goes to reliance Digital and buy mobile phone from there, here price charged by reliance (i.e. transaction value) shall be treated as value of supply.}

Section 15(2): The value of supply shall include–––

- any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the State Goods and Services Tax Act, the Union Territory Goods and Services Tax Act and the Goods and Services Tax (Compensation to States) Act, if charged separately by the supplier;

- any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both;

EXPLANATION:

- In this case contractual liability on supplier but paid by recipient hence included in value of

- In this situation payment will not be received from supplier, normally ITC has to be reversed if payment not received but in this situation no reversal has to be

(EXAMPLE: Mr. Rishabh buy certain goods from M/s Manita Polycot mills, in this case transportation charges is paid by Mr. Rishabh on behalf of M/s Manita Polycot Mills, here liability of paying transportation charges is on M/s Manita Polycot mills but paid by rishabh hence this expense is also added while calculating transaction value although payment regarding this expenses shall not be payable by rishabh to M/s manita polycot mills because Mr. rishabh has already paid that amount to third party on behalf of M/s Manita Polycot Mills.

- incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services;

Examples: Loading, unloading, inspection, testing charges etc.

- interest or late fee or penalty for delayed payment of any consideration for any supply; and

EXPLANATION:

- There is no GST on normal interest because normal interest is just due to transaction of money. But here interest word is used with penalty and late fees means this interest is due to violation of agreed terms hence GST Shall be

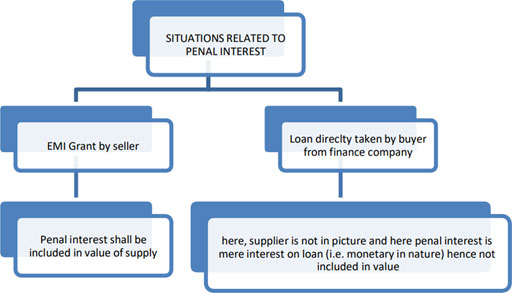

• GST ON PENAL INTEREST ON EMI:

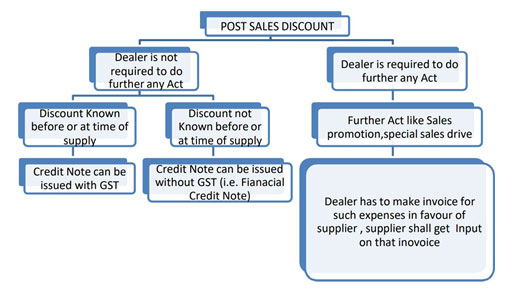

POST SALES DISCOUNT:-

- Quantity Discount : if any person buys 10 quantity of particular product and for that he will get 11 quantity of that product for the price of 10 quantity then this is treated as trade discount hence

CASE STUDY: CCE v. Hindustan Lever

SECTION 15 (4): Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed.