GST ON SALE OF COMMERCIAL PROPERTY

Note : GST will not be applicable on residential property sales or the sale of land devoid of any structures.

Q. Whether GST Will be applicable on sales of Commercial Property ?

Ans. : Yes, GST will be applicable unless and until sales after completion certificate.

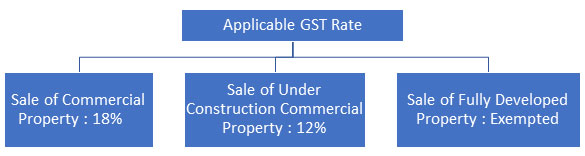

Q. GST Rate on sale of commercial immovable property ?

Ans.

- Sale of Immovable Property is subject to GST Rate.

- GST on sale of commercial immovable property or GST on sale of under-construction commercial property is subject to 12% tax.

- This tax obligation falls upon the developer or builder responsible for the commercial property, who is mandated to remit the tax to the government.

- Fully developed commercial properties or the resale of such properties get exempted from GST. This translates to the fact that if you purchase a fully constructed or resale commercial property, you are not liable to pay GST for the transaction.

Q. What will be the Regulations Applicable on sale on Immovable Commercial Property ?

Ans.

- Wide Applicability: GST extends its reach to encompass all types of immovable properties, including both residential and commercial properties.

- Builder’s Responsibility: Developers engaged in constructing commercial properties are mandated to register for GST and uphold regular filing of GST returns with governmental authorities.

- Rental Taxation: The property’s rental income typically attracts GST at an 18% rate. Additionally, individuals paying rent must also factor in a 10% income tax deduction if the annual rent surpasses 2.4 lakhs.

- Under-Construction or New Properties: According to the revised 2022 update, the GST rate applicable to the sale of under-construction or recently constructed commercial properties stands at 12%.

- Exemption for Fully Constructed or Resale Properties: Fully developed commercial properties or those being resold get exempted from GST implications.

- Input Tax Credit for Developers: Builders or developers of commercial properties are entitled to claim an input tax credit (ITC) on the GST paid for goods and services utilized during the property’s construction.

Q. Whether GST will be applicable on Construction of Commercial Property ?

Ans. Absolutely, there is GST on the construction of commercial property. The current GST rate for commercial property construction services stands at 18%, encompassing both Central GST (CGST) and State GST (SGST).

Q. Whether Taxpayer is eligible to claim refund of Input tax Credit ?

Ans. No Refund is Permissible.