GST Rates on Supply of Property

Definition of Residential Real Estate : Residential Real Estate property means where the commercial property related carpet area is not more then 15% of total carpet area of the Property.

Before moving to the rates of GST in case of Sales or Transfer of Property, I want to highlight two most important things here :

- CBIC Circular No. 177/09/2022 Dated 3rd August 2022 : as per this circular GST will not be applicable in case of sale of land without any development or sale of land post certain development like levelling, Laying down of water/electricity line etc. because the same is covered under the entry no 5 of schedule III of CGST Act.

- Para 5(b) of Schedule II of CGST Act, 2017 : GST will only be applicable in case of sale of under constructed property. That means GST will not be applicable in case of sale of property after issuance of Completion Certificate of first Occupation whichever is earlier.

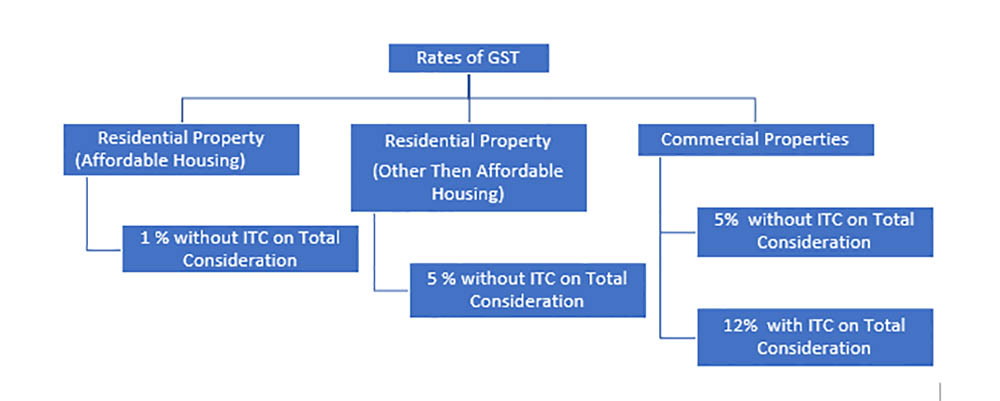

Now, we will read various Application Rates of GST which will be applicable in case of Sales/Transfer of Property :

Note : Total Consideration should be taken after 1/3 reduction on account of Land Part.

Specific Condition for this new Rate :

- Input tax credit shall be Available.

- 80% of the input and input service should be purchased from Registered Person. If there is any shortfall from registered person purchase then buyer has to pay tax under Reverse Charge Mechanism.

- 18% GST will be applicable in case of shortfall.

- Procurement from Registered and Unregistered person should me maintained product wise and if there is any shortfall then balance tax should be paid by 30th June of next Financial Year.

Author :

CA SACHIN JAIN