IMPORTANT POINTS FOR ITR FILLING

- PY 2023-24 (AY 2024-25), NEW TAX REGIME IS DEFAULT TAX REGIME.

- DUE DATE OF ITR FILLING WILL BE 31ST JULY, 2024.

- IF YOU WANT TO OPT FOR OLD TAX REGIME THAN BEFORE FILLING ITR YOU HAVE TO FILE ONE MORE FORM 10-IEA MANDATORY.

- FOR SALARIED EMPLOYEE NO NEED TO FILE 10-IEA, THEY HAVE OPTION AT THE TIME OF RETURN FILLING EVERY YEAR.

- BUSINESSMAN OR PROFESSIONAL WANT TO OPT FOR OLD TAX REGIME THAN LAST DAY TO TAKE THIS OPTION IS DUE DATE I.E. 31ST JULY, 2024 ONLY, OTHERWISE FILE RETURN IN NEW TAX REGIME ONLY.

- BUSINESSMAN OR PROFESSIONAL WILL TAKE OPTION OF 10-IEA ONLY ONCE IN LIFETIME SO ONCE YOU FILL THE FORM EVERY YEAR YOUR RETURN WILL BE FILED IN OLD TAX REGIME ONLY, TILL NOW THERE IS NO PROVISION FOR BACK TO NEW REGIME FOR BUSINESSMANS OR PROFESSIONALS.

- SALARIED EMPLOYEE STANDARD DEDUCTION OF 50000 ALLOWED IN NEW AS WELL AS OLD REGIME.

- CONCEPT OF MARGINAL RELIEF UNDER NEW TAX REGIME

- If the tax computed on your income under the new regime exceeds even the additional income over ₹7 lakh, you will be eligible for relief for the excess amount of tax.

- For example, if your total taxable income is between ₹7 lakh and ₹7.5 lakh after claiming eligible deductions, you will only need to pay taxes for income slightly above ₹7 lakh. If your total taxable income is ₹7,10,000, the tax payable will be ₹10,000 instead of ₹26,000.

Marginal Relief: Under the new tax regime, if your taxable income exceeds ₹7 lakh, you may be eligible for marginal relief. This relief ensures that the tax payable does not exceed the income that exceeds ₹7 lakh. Specifically:

Remember that this relief is designed to benefit small taxpayers and prevent excessive tax burdens.

- Under the new tax regime, you do not need to keep track of rent receipts, travel tickets, and complicated tax planning. The new tax regime offers lower tax rates and fewer deductions. This eliminates the need to invest in tax-saving schemes and insurance plans which may not align with your financial goals.

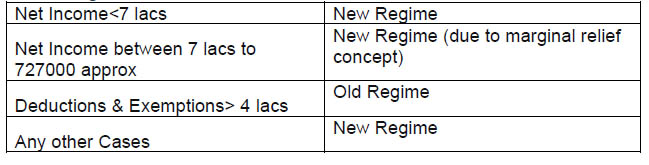

Which regime is better for whom