INCOME TAX: PLANNING & INVESTMENTS OPTIONS

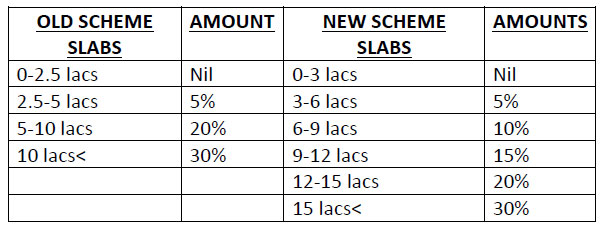

TAX SLABS UNDER OLD SCHEME V/S NEW SCHEME

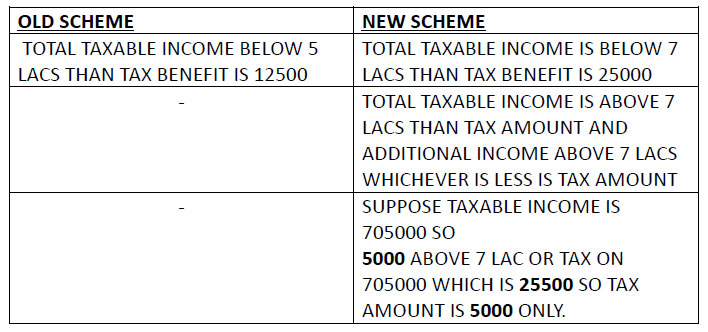

REBATE U/S 87A OLD SCHEME V/S NEW SCHEME:

- STANDARD DEDUCTION 50,000 FOR SALARIED EMPLOYEE IN BOTH NEW AS WELL AS OLD REGIME

- NO OTHER DEDUCTIONS ALLOWABLE UNDER NEW REGIME EXCEPT CONTRIBUTION TO AGNIVEER CORPUS FUND (80 CCH), INTEREST ON HOME LOAN ONLY ON LET OUT PROPERTY, EMPLOYER CONTRIBUTION TO NPS, STANDARD DEDUCTION ON PENSION.

COMMON DEDUCTION UNDER OLD REGIME

- 80C, 80CCC, 80CCD AGGREGATE=1.5 LAC

- 80CCD(1B) =50,000

- 80D (MEDICLAIM PREMIUM)

- INCOME TAX: PLANNING & INVESTMENTS OPTIONS

- 80TTA=10,000(SAVING BANK INTEREST)

- ANY OTHER APPLICABLE LIKE 80E(INT ON EDUCATION LOAN), DISABLE OR HANDICAP PERSON SPECIAL DEDUCTION, 80G (DONATIONS)

- RENTED HOUSE DEDUCTION IS 5000 PER MONTH (80GG)

- INT ON HOME LOAN (SELF OCCUPIED PROPERTY) UNDER 24(B) MAX. AMOUNT IS 2 LACS

COMMON EXEMPTION UNDER OLD REGIME:

- IN CASE OF SALARIED PERSON HOUSE RENT ALLOWANCE IS COMPONENT OF SALARY THAN EXEMPTION ALLOWED U/S 10(13A).

- LEAVE TRAVEL ALLOWANCE(LTA) EXEMPTION TO SALARIED EMPLOYEE TWICE IN EVERY 4 YEAR BLOCK.

ALL THE ABOVE DISCUSSED EXEMPTION AND DEDUCTION NOT ALLOWED IN NEW TAX REGIME.

EXAMPLE: IF TAXBLE INCOME BELOW 7,00,000 THAN DEFINETLEY GO FOR NEW REGIME AND SALARIED EMPLOYEE BELOW 7,50,000 DEFINETELY GO FOR NEW REGIME.

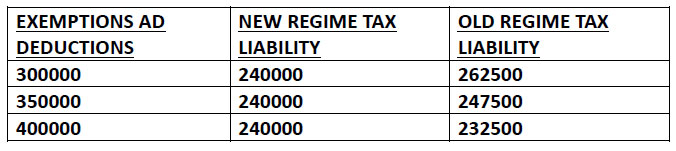

CHECK TOTAL AMOUNT DEDUCTIONS AND EXEMPTIONS ABOVE DISCUSSED YOU MAY AVAIL ACCORDINGLY CALCULATE TAX LIABLITY IN BOTH THE CASES

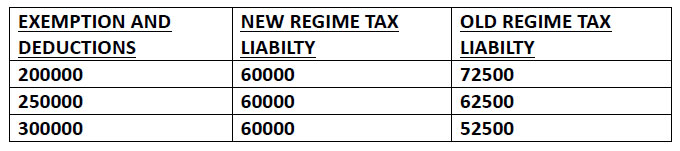

SUPPOSE YOUR TAXABLE INCOME IS 10 LACS

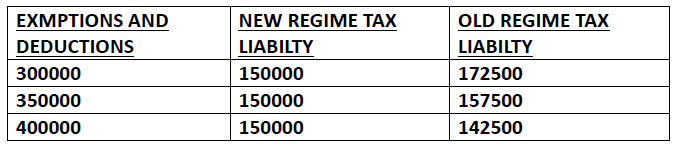

SUPPOSE YOUR TAXABLE INCOME IS 15 LACS

SUPPOSE YOUR TAXABLE INCOME IS 18 LACS

IMPORTANT POINTS

- IN CASE OF SALARIED PERSON RETURN (NO BUSINESS INCOME) EVERY YEAR OPTION TO SELECT NEW REGIME OR OLD REGIME, FROM PY 2023-24 ONWARDS DEFAULT SCHEME IS NEW REGIME BUT YOU HAVE TO OPTION CHANGE EVERY YEAR WHILE FILLING YOUR RETURN.

- IN CASE OF BUSINESS INCOME IF OPT FOR NEW REGIME THAN ONLY ONCE OPTION TO REVERSE OLD REGIME AND THAN NOT POSSIBLE TO AGAIN GO FOR NEW REGIME.