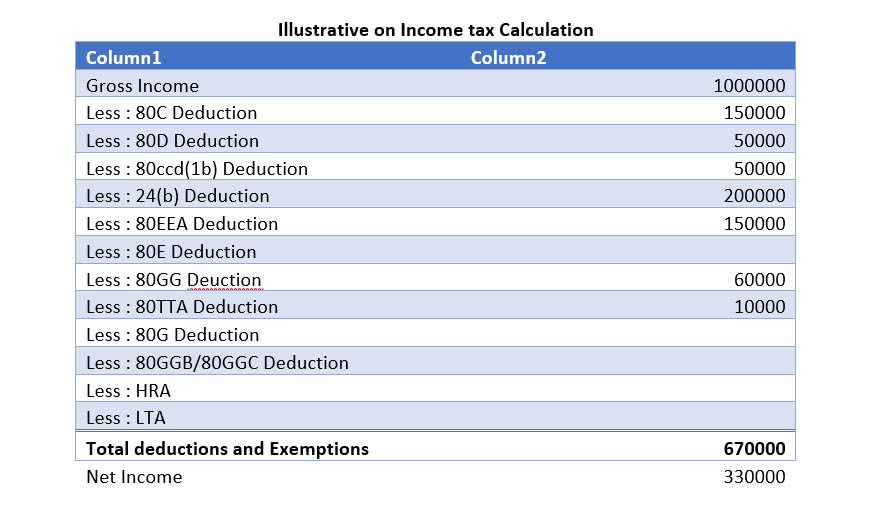

No Income tax payment required if your income is 10 Lakh Rupees P.a.

Section 80C: This is perhaps the most well-known píovision. It allows deductions foí investments such as:

Equity Linked Saving Scheme (ELSS)

National Pension Scheme (NPS)

Unit Linked Insuíance Plan (ULIP)

Public Píovident Ïund (PPÏ)

Sukanya Samíiddhi Yojana (SSY)

National Savings Ceítificate (NSC)

Section 80D: Deductions for health insurance premiums paid for self, family, and parents.

Section 80E: Interest on education loans.

Section 24b: Interest on home loan EMIs.

Section 80EEA: Inteíest on home loan additionally than 24b if your house stamp duty value is below 45lacs and you are first time homebuyers

Section 80CCD (1B): Additional deduction for National Pension Scheme (NPS) investments.

Section 80G of the Indian Income Tax Act allows tax deductions foí contributions made to certain relief funds and charitable institutions. By donating to eligible oíganizations, you can claim deductions ranging from 50% to 100% of the donated amount.

Section 80GGB/80GGC for political party donation get 100% refund

80TTA deduction for saving bank interest

The lowest of the following amounts can be claimed as HRA exemption:

- Actual HRA received.

- 50% of basic salary + DA for metro cities (Delhi, Kolkata, Mumbai, oí Chennai).

- 40% of basic salary + DA for non-metro cities.

- Actual íent paid minus 10% of basic salaíy + DA

House Rent allowance for salaried employee.

HRA and Home Loan Interest Deduction:

You can claim both HRA exemption and home loan interest deduction.

If you live in a rented house while owning one in the same city, you can justify the claim based on valid reasons (e.g., office location far from your owned house).

LTA is exempt from tax under Section 10(5) of the Income Tax Act.

The exemption amount is either the actual travel costs or the cost of an economy class ticket, whichever is lower.

LTA or LTC (leave travel concession) for salaried employee only.

Section 80GG in case of HRA not received (generally in case of other than salaried person) than deduction for rent paid maximum limit in 60000 annually.

Surprisingly when you add up all the exemptions and deductions than our tax liability is nil or negligible even your income up to 20 lacs so check out with our excel calculation and save your taxes

Author

CA. ANKITA BOTHRA