201 IMPORTANT JUDGEMENTS UNDER GST – COMPLETE PRACTICAL GUIDE

₹2,117.80 Original price was: ₹2,117.80.₹1,270.34Current price is: ₹1,270.34.

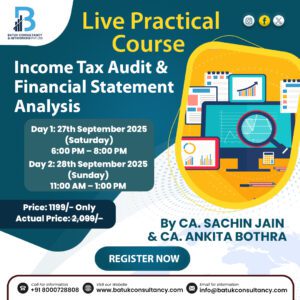

Speaker : CA SACHIN JAIN {B.COM(hons.),LLB,ACA,CS,DISA}

Price: 1499 Including GST

Content: Recorded Video

Validity: 2 Month

Out of stock

We have observed that Professionals have sufficient knowledge of provisions of law but many time they are facing multiple issues while Applying the same in Practical cases. Thus it gives un an immense pleasure in introducing this course on Important Case Studies with Explanation in a practical way for conceptual clarity of Professionals so that they can apply the same in their practical cases. This course is completely based on Analysis of various Judgements Pronounced by Supreme Court, High Court, AAR, AAAR Authorities. In this course we had covered Multiple case studies from Analysis Purpose Also.

For better understanding we have used various live practical examples in this course. This course is useful for Departmental Authorities as well as for Tax Professionals. In this course we have also covered relevant section, with rules for user’s quick reference. We have covered many important judgments in this course which are related to those issues which are used in our daily routine GST Practice and also useful as reference for various debatable/disputed cases. This course is completely simplified for better understanding of laymen. We have tried our best to touch each and every important Judgements in this course.

Features of this course :

- Landmarking Judgements with Concept of law

- Live Practical Examples for easy understanding

- Judgements covering high court, supreme court, AAR, AAAR

- Detailed Analysis of law with live case studies

Reviews

There are no reviews yet.