Combo – The GST Question Compendium + The Definitive Guide to GST – Laws, Cases, and Practices + Decisive GST Cases – 250 Landmark Judgements

₹3,697.00 Original price was: ₹3,697.00.₹2,657.90Current price is: ₹2,657.90.

Combo Books – The GST Question Compendium + The Definitive Guide to GST – Laws, Cases, and Practices + Decisive GST Cases – 250 Landmark Judgements

Combo Offer : 30% Off

Price :3797/- 2657.9

Published By : Batuk Academy

Author : CA SACHIN JAIN

25% DISCOUNT INDEPENDENCE DAY OFFER

Use Coupon Code : INDEP25

Book 1

The GST Question Compendium

Unveiling “The GST Question Compendium” – India’s First Handwritten Book by CA Sachin Jain, Published by Batuk Academy

Step into a world of practical GST knowledge with “The GST Question Compendium” – a groundbreaking book that stands out as India’s first handwritten publication. Authored by the esteemed CA Sachin Jain and published by Batuk Academy, this compendium is a must-have for professionals seeking to deepen their understanding of GST through real-world, practical Q&A.

Why This Book is Truly Unique:

- India’s First Handwritten Book: Experience the personal touch and meticulous effort that went into creating this one-of-a-kind resource. Every page is handwritten, offering a unique reading experience that blends tradition with modern insights.

- Practical Q&A Format: Navigate through multiple practical questions and answers designed to address the day-to-day challenges faced by GST professionals.

- Expert Insights: Learn directly from CA Sachin Jain, whose extensive experience in GST shines through in every answer, ensuring you get reliable and actionable solutions.

- Published by Batuk Academy: Backed by a renowned publisher, this book is crafted to meet the highest standards of accuracy and relevance.

What You’ll Find Inside:

- Real-World Scenarios: Detailed Q&As that tackle the most common and complex GST issues, ensuring you’re prepared for any situation.

- Clear Explanations: Understand the reasoning behind each answer with simple, yet comprehensive explanations.

- Hands-On Approach: The practical nature of this book ensures that it is not just a reference guide, but a tool you can use in your daily professional life.

Perfect For:

- Chartered Accountants

- Tax Consultants

- GST Practitioners

- Anyone involved in GST compliance and advisory

Get Your Copy Today! “The GST Question Compendium” is more than just a book—it’s a revolution in how GST knowledge is shared. Don’t miss out on this unique opportunity to own India’s first handwritten book, packed with practical insights that will enhance your professional expertise.

Order now and be part of a historic publication that blends tradition with cutting-edge GST solutions!

Book 2

The Definitive Guide to GST – Laws, Cases, and Practices

Presenting “The Definitive Guide to GST – Laws, Cases, and Practices” by CA Sachin Jain – Your Comprehensive Resource for Mastering GST

Simplify your understanding of GST with “The Definitive Guide to GST – Laws, Cases, and Practices,” a must-have book for professionals and laypeople alike. Authored by CA Sachin Jain and published by Batuk Academy, this book breaks down the complexities of GST law into clear, easily understandable language, while providing industry-specific insights and practical examples that make learning both comprehensive and engaging.

Why This Book is Essential:

- Complete Coverage of GST Law: Dive deep into the entire spectrum of GST law, explained in a simplified manner to ensure clarity and ease of understanding.

- Practical Approach: The book is packed with multiple live practical examples, making it an invaluable resource for professionals who need actionable insights.

- Industry-Specific Insights: Tailored to address the unique challenges faced by different industries, this guide provides targeted advice that you can apply directly in your work.

- Enhance Your Skills: Designed to bolster both your conceptual and technical skills, this book is ideal for those looking to deepen their expertise in GST practices.

- Accessible Language: Written in straightforward, easy-to-understand language, this book ensures that even those new to GST can grasp the concepts and apply them effectively.

What You’ll Gain:

- Clear Understanding of GST Laws: Simplified explanations of complex legal terms and provisions make this book accessible to everyone.

- Real-World Applications: Learn from practical examples that show how GST laws are applied in various industry scenarios.

- Strategic Insights: Gain a deeper understanding of how to navigate GST challenges with confidence and accuracy.

- Conceptual and Technical Mastery: Build a strong foundation in GST law that will enhance your ability to handle GST practices effectively.

Perfect For:

- Chartered Accountants

- Tax Consultants

- GST Practitioners

- Business Owners

- Anyone looking to understand GST in a simple, practical way

Published by Batuk Academy: Backed by a publisher known for quality and reliability, “The Definitive Guide to GST” is a resource you can trust to provide accurate and up-to-date information.

Order Your Copy Today! Whether you’re a seasoned professional or just starting your journey in GST, “The Definitive Guide to GST – Laws, Cases, and Practices” is the ultimate resource you need. Simplify your learning and enhance your skills with this essential guide. Don’t miss out—order your copy today and take the first step toward mastering GST!

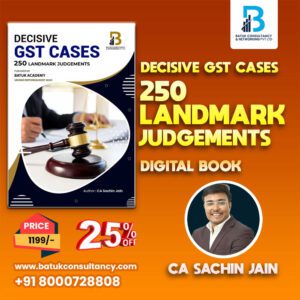

Book 3

Decisive GST Cases – 250 Landmark Judgements

Introducing “Decisive GST Cases – 250 Landmark Judgements” by CA Sachin Jain – Your Essential Guide to Mastering GST Litigation

Navigate the complexities of GST litigation with confidence by diving into “Decisive GST Cases – 250 Landmark Judgements.” Authored by CA Sachin Jain and published by Batuk Academy, this book is a crucial resource for professionals who want to stay ahead in the ever-evolving world of GST.

Why This Book is Indispensable:

- Comprehensive Landmark Judgments: Delve into 250 recent landmark judgments pronounced by various AAR, AAAR, High Courts, and the Supreme Court. Each case is carefully selected to provide you with a thorough understanding of pivotal GST rulings.

- Practical Approach: The book is not just about theory; it is rooted in practicality. Every judgment is analyzed with a focus on real-world application, making it easier for you to apply these insights in your practice.

- Enhance Your Analytical Skills: Gain a deeper understanding of GST litigation and improve your ability to analyze complex legal situations. This book is designed to sharpen your analytical skills, making you better equipped to handle challenging cases.

- Essential for Litigation: In the current scenario, where litigation is increasingly prevalent, this book is a must-have for anyone involved in GST compliance, advisory, or dispute resolution.

What You’ll Learn:

- Key Takeaways from Landmark Cases: Understand the implications of each judgment and how it impacts GST practices.

- Case-by-Case Analysis: Detailed breakdowns of each case, with insights into the reasoning behind the rulings and their practical applications.

- Strategic Insights: Learn how to approach litigation strategically, using the knowledge gained from these landmark cases.

Who Should Read This Book:

- Chartered Accountants

- Tax Consultants

- GST Practitioners

- Legal Professionals involved in GST litigation

Published by Batuk Academy: Known for their commitment to excellence, Batuk Academy brings you a publication that meets the highest standards of legal accuracy and practical relevance.

Order Your Copy Today! Equip yourself with the knowledge and skills needed to excel in GST litigation. “Decisive GST Cases – 250 Landmark Judgements” is your comprehensive guide to understanding and navigating the complexities of GST law. Don’t miss out on this essential resource—order your copy today and take your practice to the next level!

Reviews

There are no reviews yet.