GST AUDIT & ASSESSMENT – PRACTICAL GUIDE (Video course)

₹499.00

In this live webinar we are going to discuss on various provisions related to GST Audit & Assessment from Department Point of view. This webinar is very much useful for GST Officers and Staff. In this webinar we will cover each and everything from Practical Aspects with live practical Examples. In this live webinar we are going to cover following topics :

CONTENT COVERAGE :

Provisional & Self Assessment from Department Point of View : In this segment we are going to discuss on Practical Aspects of Provisional and Self Assessment. We will discuss the basic as well as Technical Provisions of Provisional and Self Assessment.

Assessment of Unregistered Persons : In this Segment we are going to discuss that how departmental Authority can Assess the liability of Unregistered Person and how they can identify the liability of that person.

Assessment of Non Returns Filers : In this Segment we are going to discuss that how departmental Authority can Assess the liability of Non Return filers and how they can identify the liability of that person.

Scrutiny of Returns : In this segment we are going to discuss on various practical aspects of scrutiny of returns. Also will discuss on the important parameters on which department authority needs to give more importance while finalising the scrutiny of returns.

Identification Techniques for finding Revenue Leakage : This segment will be the heart of our discussion, in this segment we are going to discuss on various important tools to identify the revenue leakage during departmental audit.

Practical Aspects Regarding Demand & Recovery : In this segment we are going to deeply discuss on various important aspects of Section 73 & 74 of CGST Act with live practical Examples.

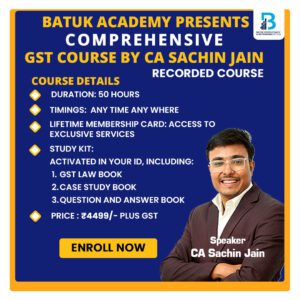

About Trainer

CA SACHIN JAIN

{B.COM(hons.),LLB,ACA,CS,DISA}

CA. SACHIN JAIN is a practicing chartered accountant and partner at M/S JAIKUMAR JAIN & COMPANY, a leading ca firm in Rajasthan. He is a young and dynamic chartered accountant with unique and innovative thinking. He has vast experience in the field of Indirect Taxation, Auditing, and Commercial Laws etc. He is an advocate and company secretary also. He has trained more than 20,000 professionals across India. He has written many articles on GST, concurrent Audit, MCA Compliances etc. He has authored the book namely “71 Important Decisions under GST”, ‘Simplified GST Guide’.

Fees : 299