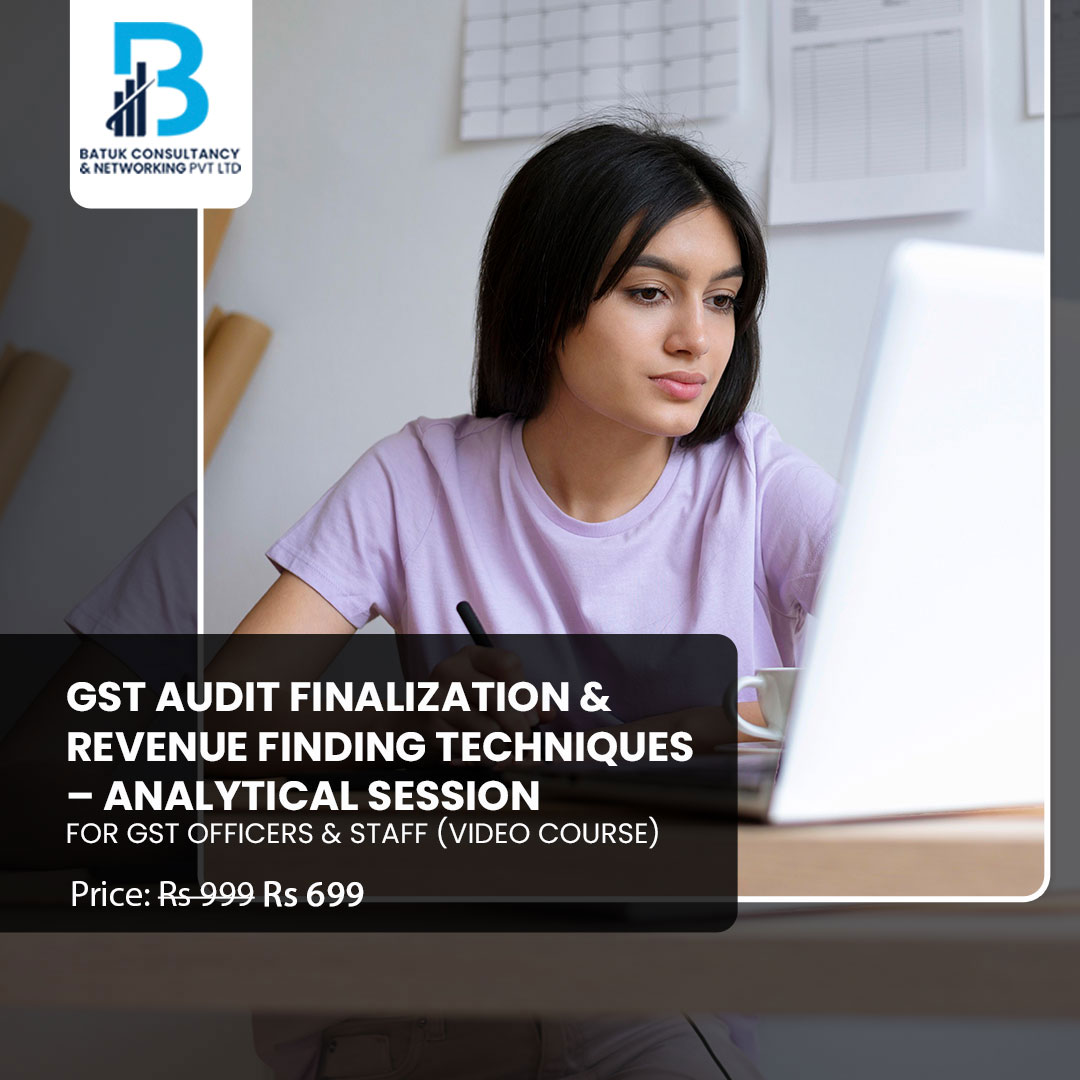

GST AUDIT FINALIZATION & REVENUE FINDING TECHNIQUES – ANALYTICAL SESSION FOR GST OFFICERS & STAFF (Video Course)

₹999.00 Original price was: ₹999.00.₹699.00Current price is: ₹699.00.

Actual Price : 999/-

Discounted price for Registrations – 699/-

This Course is Specially designed for GST Officers and Staff based on current need of work Environment. As we all now that now a days department is handling multiple GST Audit and Assessment related cases and they are quite confused while deciding the liability of the tax payers with regard to provision of law. Also there is one more issue is that departmental authorities are very much concerned about the revenue leakage finding during the GST Audit and Scrutiny. Considering all these facts we are coming with this Video course specially designed for GST Officers & Staff. Will include following things in this course :

- Techniques based finalisation of GST Audit : In this segment will discuss about the complete techniques related to finalisation of GST Audit in a simplified way. Will also discover multiple theories to complete the GST Audit in a more Effective and Efficient way.

- Techniques to understand the GST : one of the major problem is that we are very confused about the applicability of GST on Particular transaction. In this segment will discuss about the various techniques through that one can easily decide the taxability and rate of GST in different different Situations.

- Analysis of Financials based on Revenue leakage : In this segment will discuss about multiple Important and unexplored techniques from revenue leakage identification perspective. Currently departmental Authorities are quite confused while determining the Revenue leakage from the Analysis of Financial Statements perspective. In this segment will provide the complete guidance about the Revenue leakage finding techniques.

- Linkage of Provisions with GST Audit : In this segment will also discuss about the complete linkage of various provisions of GST Law with respect to GST Audit and revenue finding techniques.

- Analysis of Financial Statement from GST Audit Perspective : In this segment will discuss about various interesting techniques for GST Audit in a smooth way

-

- This course will be the complete set of skills for GST officers & Staff. Will also discuss the complete things with live practical data only.

- This course will be completely based on interactive Approach.

- Complete Recording will be provided for your Future Reference.

- Study set will provided completely in chart and tabular form for easy understanding.

Actual Price : 999/-

Discounted price for Registrations – 699/-

Faculty : CA SACHIN JAIN

Reviews

There are no reviews yet.