Introducing Our Revolutionary GSTR-2B and Books Input Reconciliation Tool!

₹10,000.00 Original price was: ₹10,000.00.₹5,000.00Current price is: ₹5,000.00.

Are you tired of spending countless hours manually reconciling your GSTR-2B with your books? Do you wish there was a more efficient and accurate way to ensure that your GST returns align seamlessly with your financial records? Look no further – our cutting-edge GSTR-2B and Books Reconciliation Tool is here to transform your compliance processes!

🚀 Key Features:

- Automated Reconciliation: Say goodbye to manual data matching! Our tool automates the reconciliation process between your GSTR-2B and accounting books, saving you time and reducing the risk of errors.

- Real-Time Updates: Stay on top of your compliance game with real-time updates. Receive instant notifications about any discrepancies, enabling you to address issues promptly and ensure accurate reporting.

- User-Friendly Interface: Our intuitive interface is designed with you in mind. No more complicated procedures or steep learning curves – reconcile your data effortlessly and focus on what matters most: your business.

- Data Accuracy Assurance: Rest easy knowing that our tool employs advanced algorithms to cross-verify data, ensuring accuracy in your GSTR-2B and books reconciliation. Minimize the risk of costly mistakes and audits.

- Customizable Reports: Generate comprehensive reports tailored to your specific needs. Whether you require detailed insights or a high-level overview, our tool provides customizable reports to suit your preferences.

- Secure and Compliant: Your data security is our top priority. Our tool adheres to the highest industry standards, ensuring that your sensitive information remains confidential and compliant with data protection regulations.

- Time and Cost Savings: By automating the reconciliation process, our tool not only saves you time but also reduces the overall cost of compliance. Invest your resources where they matter most and watch your efficiency soar.

- 24/7 Support: Have a question or need assistance? Our dedicated support team is available around the clock to provide guidance and ensure a smooth experience with our reconciliation tool.

🌐 Seamless Integration: Our tool seamlessly integrates with popular accounting software, making the transition to automated reconciliation a breeze. No need to overhaul your existing systems – simply enhance them with our state-of-the-art solution.

📈 Unlock Efficiency, Ensure Compliance, and Boost Your Bottom Line with Our GSTR-2B and Books Reconciliation Tool!

Ready to experience a new era of GST compliance? Contact us today for a personalized demonstration and take the first step toward a more streamlined, accurate, and efficient reconciliation process. Your business deserves the best – and our tool delivers just that.

This tool helps to reconcile the Input credits of GSTIN portal data of B2B files with Party’s own records of B2B transactions. The tool not only provide a reconciled list of transaction but also as well generates additional reports. It generates compiled list of all the portal data in one report separately as well as same it does for party’s own data.

A dedicated folder created for loading the transaction files. Files are in .xlsx format and once the IRT is configured, output reports are generated and can be used at any instant.

The reconciliation produces Result in following 7 categories:

- Match

- Invoice date mismatch

- Invoice number mismatch

- Invoice value mismatch

- Not in Portal

- Not in Party

- Tax mismatch

The tool takes care of match or mismatch based on following attributes of portal data and party data:

- GSTIN of supplier

- Invoice number

- Invoice Date

- Invoice Value

- Taxable Value

Features:

- Reconciliation of party and portal data and trace mismatches in fraction of moment.

- Filter capability of results with Party and portal records dates, match result

- Capability to filter individual GSTIN

- Multi month/ multi year data can be compiled and can be traced back date/month/year wise, so keeping in multi month year/data is possible.

- Consolidated figures are also available for loaded data and possible to trace any period figures.

- Additional columns can be used in table visuals or removed if not needed.

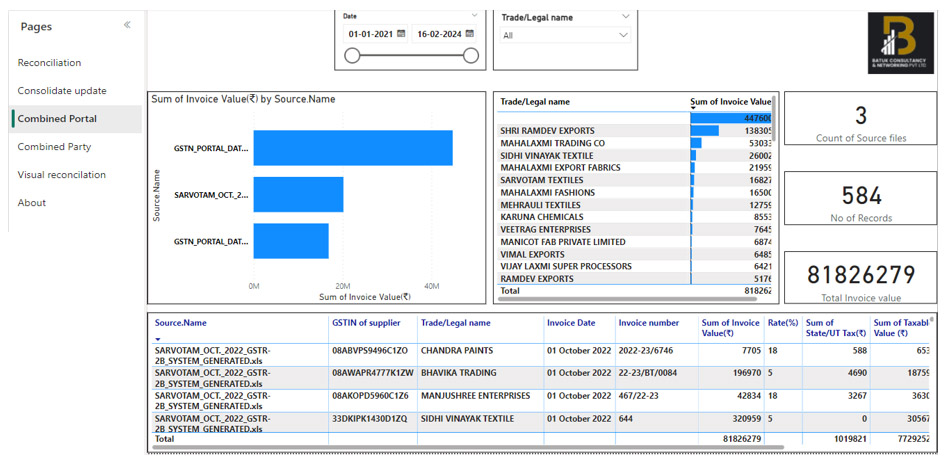

A brief description of the visuals/tables shown in tool reports page wise is as below:

- Reconciliation On this page, user can find reconciliation of his own/party records and portal records.

Table -1 Description on field names used in the tool report

*Party data are without any prefix and Portal data are with B2B_Portal. Prefix. Wherever Date or Invoice Date appears, it is party record. A portal date shall appear as B2B_Portal.Invoice Date.

- Consolidate update : On this page, user can find consolidated or summarized report on reconciliation results.

- Combined Portal : On this page, user can find compilation of all the excel files of his own/Party records. So it provides appended report of all the excel files loaded. This shall be helpful in case user wish to see a combined view of party records for several months or years in one place. This combined result can then be exported in form of a single excel file for further usage.

- Combined Party : On this page, user can find compilation of all the excel files of his own/Party records. So it provides appended report of all the excel files loaded. This shall be helpful in case user wish to see a combined view of party records for several months or years in one place. This combined result can then be exported in form of a single excel file for further usage.

- Visual reconciliation: On this page, user can see a visual representation of reconciliation and find result with legend color and tool tip text. Zoom sliders helps to zoom too extreme values.

GSTR -2B AND BOOKS INPUT RECONCILIATION TOOL (WITH UNLIMITED ACCESS)

Price of the tool : 4000/-

Designed & Developed by : ER. Mahendra Kumar Jain

Reviews

There are no reviews yet.