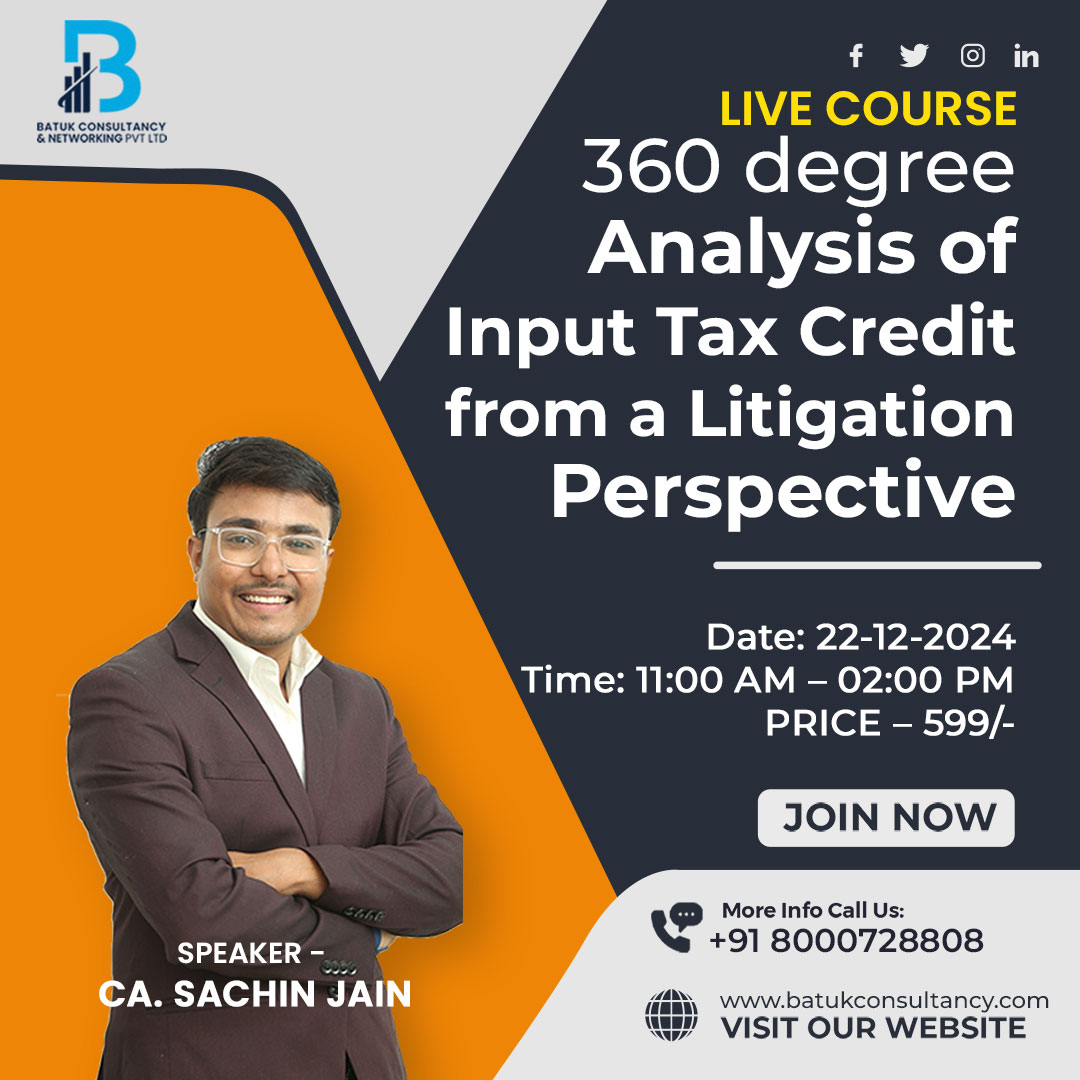

Live Course on 360 degree Analysis of Input Tax Credit from a Litigation Perspective

₹599.00

Instructor: CA Sachin Jain

Date: 22-12-2024

Time: 11:00 AM – 02:00 PM

Platform: ZOOM Interactive Platform

PRICE OF THE COURSE – 599/-

Instructor: CA Sachin Jain

Date: 22-12-2024

Time: 11:00 AM – 02:00 PM

Platform: ZOOM Interactive Platform

Unlock the intricacies of Input Tax Credit (ITC) with our comprehensive live course designed to provide an in-depth analysis from a litigation perspective. This course is essential for professionals seeking to master the practical aspects of ITC and navigate the complexities of GST compliance.

Course Highlights:

- Complete Analytics of Input Tax Credit: Delve into the fundamentals of ITC, exploring the detailed flow of credit eligibility and the restrictions imposed. In this segment will discuss all the aspects completely in a practical way with facts and figures.

- Understanding Litigation Causes: Learn why ITC is the root cause of many present and future litigations and how to manage these challenges effectively. In this segment will also cover the 360 degree analysis of litigation from GST Perspective.

- Blocked Credit under GST: Gain a thorough understanding of blocked credits, their implications, and strategies to handle them. In this segment will cover the each and every item of blocked credit with live practical examples for easy understanding.

- Apportionment of Credit: Engage in a detailed discussion on the apportionment of credit, supported by live practical examples to ensure clarity and application in real scenarios.

- Practical Analysis of CGST Rules 42 and 43: Analyze the complete practical implications of Rules 42 and 43 of the CGST Rules, illustrated with practical examples for better understanding.

Why Enroll in This Course?

- Expert Guidance: Learn from CA Sachin Jain, a seasoned professional with vast experience in GST and taxation.

- Practical Insights: This course is designed to be entirely based on practical analytics, providing you with actionable knowledge and skills.

- Real-World Examples: Benefit from live practical examples that make complex concepts easy to understand and apply.

Course Benefits:

- Enhanced Understanding: Build a solid foundation in ITC and its litigation aspects.

- Practical Knowledge: Apply what you learn through real-life scenarios and examples.

- Professional Growth: Equip yourself with the expertise to handle ITC-related issues effectively, enhancing your professional capabilities.

Who Should Attend?

- Tax professionals

- Accountants

- GST practitioners

- Commerce graduates and post-graduates

- Business owners and managers involved in GST compliance

Register Now!

Don’t miss this opportunity to gain expert knowledge and practical skills in ITC from a litigation perspective.

Contact Us:

For more details or any queries, reach out to info@taxgurur.in

Equip yourself with the knowledge and skills to navigate the complexities of Input Tax Credit and stay ahead in your professional journey.

PRICE OF THE COURSE – 599/-

Reviews

There are no reviews yet.