This book is designed for CA,CS AND CMA Final Students. This book is a complete guide for students. In this book we had covered complete syllabus as per Institute Module with various examples for better understanding. Also covered various sample questions for your better understanding and preparation for exams. The content of this book is as under :

- GST – Introduction

- Supply under GST

- Charge of GST

- Exemptions under GST

- Place of supply

- Time of Supply

- Value of Supply

- Input tax Credit

- Registrations

- Tax Invoice

- Credit and Debit Notes

- Accounts & Records

- E- Way Bill

- Payment of Taxes

- Returns under GST

- Import and Exports

- Refunds under GST

- Job Work under GST

- Audit & Assessment

- Inspection under GST

- Search, Seizure and Arrest

- Demand & Recovery under GST

- Liability to pay in certain cases

- Offences & Penalties

- Appeal & Revision – under GST

- Advance Ruling

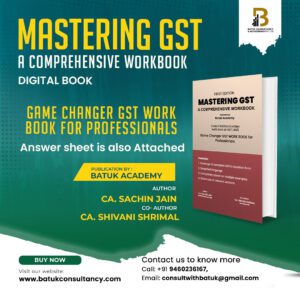

![book-sachin-jaini]mmpli]fi]egt](https://batukconsultancy.com/wp-content/uploads/2023/07/book-sachin-jainimmplifiegt.jpg)

Reviews

There are no reviews yet.