GST Audits Decoded: Strategies for Officers and Staff

₹495.00 Original price was: ₹495.00.₹199.00Current price is: ₹199.00.

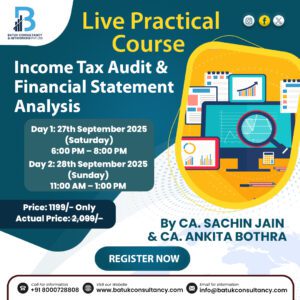

TAX AUDIT FROM GST LAW PERSPECTIVE – COMPLETE GUIDE

₹1,000.00

This unique course cover following concepts :

- Basics of Tax Audit

- Relevant Clauses of Form 3CD

- Analysis of Financials from GST Perspective

- Analysis on Various Reconciliations

- Discussion on Various Observations and Qualification under Tax Audit Report

Speaker : CA SACHIN JAIN

Out of stock

SKU:

BATUK-TA-GST-LAW

Categories: Courses, Live Online Classes

Description

As we all know, this time is specially known for Tax Audit Season for Chartered Accountants and Business Owners as well. For providing the complete Clarity regarding GST Law from Tax Audit Perspective we are coming with a live course on Important Points from GST Law while doing the Tax Audit. This subject is very much useful for each and every auditor. With that objective we are presenting this unique course with following concepts :

- Basics of Tax Audit : In this segment we will discuss about basics of tax Audit with industry wise examples. Also we will discuss about various hand handling techniques for doing the tax audit in a effective way.

- Relevant Clauses of Form 3CD: In this segment we will discuss about various Relevant Clauses of form 3CD from GST Perspective like cluse no. 27A, 44 etc. also we will discuss about Importance of Related Party Transactions, Unsecure Loan Related Provisions from GST Perspective.

- Analysis of Financials from GST Perspective : In this segment we will discuss about Analysis of financial Statements. We will also cover the analysis of each and every term of various financial statements and uses thereof. This discussion will be very much useful from litigation perspective as well.

- Analysis on Various Reconciliations : In this segment we will discuss about various Reconciliations which is very much important from tax audit perspective. The Discussion will be completely based on Practical Approach.

- Discussion on Various Observations and Qualification under Tax Audit Report : In this segment we will discuss about various observations and qualifications, which we should put in our tax audit reports. Also we will discuss about various GST Related Check list to identify fake transactions and Reconciliations thereof.

Reviews (0)

Be the first to review “TAX AUDIT FROM GST LAW PERSPECTIVE – COMPLETE GUIDE” Cancel reply

Reviews

There are no reviews yet.