Understanding Your Salary Components and Saving Taxes: A Guide for Salaried Individuals

When it’s tax time, people who earn salaries get a bit stressed about the money they have to give to the government for the past year. It’s important to know your salary details to figure out how to pay less tax. If you find your pay slip confusing, don’t worry—this guide is here to help.

SECTION I – Understanding Your Payslip

Basic Salary

Your fixed salary, the bedrock of earnings, influences key components like House Rent Allowance (HRA) and a 12% Provident Fund (PF) deduction. This unchanging element constitutes a significant part of your overall income, serving as the basis for other salary segments. Explore how HRA, determined by the company’s discretion, and the 12% PF deduction play pivotal roles in shaping your total compensation

House Rent Allowance

For those who work and rent a home, you can reduce your taxes by claiming House Rent Allowance (HRA). This means a part or all of it won’t be taxed. There’s a specific way to calculate the HRA exemption as per income tax laws. Remember, if you get HRA but don’t actually live in a rented place, the entire HRA amount becomes taxable.

Scenario: Raghima’s Tax‐Savvy Move

Meet Raghima, employed at an MNC in Bangalore, where she receives a house rent allowance (HRA). Interestingly, even though she resides with her parents and not in a rented place, Raghima can still benefit from this allowance. How? By paying rent to her parents, granted they own their current residence. By entering into a simple rental agreement and transferring monthly funds to her parents, Raghima not only shows appreciation to her folks but also enjoys tax savings. It’s a win‐win! Just a heads up, Raghima’s parents will need to include the rent she pays in their income tax returns.

Leave Travel Allowance

Salaried individuals have the opportunity to enjoy tax exemption on domestic trips through Leave Travel Allowance (LTA). However, it’s important to note that this exemption covers only the shortest distance of the journey. Eligible companions for this allowance include your spouse, children, and parents, but not other relatives. The exemption is tied to actual expenses, so unless you undertake the trip and have the associated expenses, you won’t be able to claim it. To benefit from this exemption, ensure you submit the relevant bills to your employer. It’s a practical way to make your travel plans a tax‐savvy experience.

Bonus

Bonuses, whether labeled as performance incentives or by any other name, are typically dispensed once or twice a year. However, it’s crucial to note that regardless of nomenclature, bonuses are subject to 100% taxation. The performance bonus, often tied to your appraisal ratings or performance within a specific timeframe, adheres to the company’s policy. While these bonuses add a rewarding touch to your income, it’s essential to be aware of their tax implications. Whether it’s a yearly windfall or a performance‐linked reward, bonuses play by the tax rules, impacting your take‐home pay accordingly.

Navigating Employee Contribution to Provident Fund (PF)

Provident Fund (PF), a social security initiative by the Government, witnesses both employer and employee contributing 12% of the basic salary monthly towards the pension and provident fund. The latest update from the Union Budget 2023 maintains the EPF interest rate at 8.10%, with a noteworthy reduction in the TDS rate for taxable EPF withdrawals to 20% for non‐PAN holders. This is a retirement benefit that companies with over 20 employees must provide as per the EPF Act, 1952.

Standard Deduction

Shifting focus to Standard Deduction, introduced in the 2018 budget, it replaces conveyance and medical allowances. Employees can now claim a flat Rs.50,000 deduction from their total income, providing a tax relief measure. In the latest Union Budget 2023‐24, this deduction remains consistent, applicable under both the old and new tax regimes.

Professional Tax

Professional Tax, akin to income tax but levied by states, imposes a maximum limit of Rs.2,500. Usually deducted by employers and remitted to the state government, it serves as a deduction from salary income in your income tax return. Stay informed about these facets to optimize your financial strategy.

SECTION II

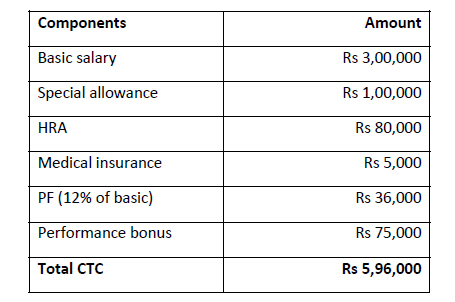

Understanding your salary involves more than just the numbers on your paycheck. The Cost to Company (CTC) encompasses not just your salary but also perks like food coupons or a cab service. Your Total CTC is the sum of these benefits and your salary.

Here’s a simplified example:

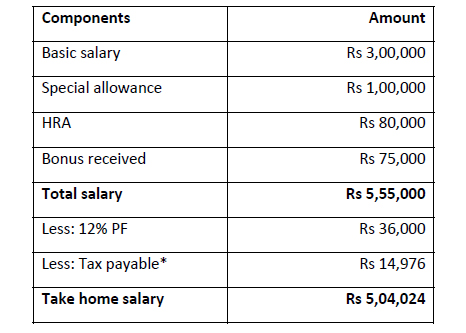

Now, your actual Take‐Home Salary is what you see on your payslip:

Remember, CTC includes your monthly salary, retirement benefits like PF, and non‐monetary perks like a cab service or medical insurance. On the other hand, your take‐home salary is the amount you actually receive after deductions, considering exemptions like HRA and taxes.

It’s essential to grasp these differences to fully understand your overall compensation package.

SECTION III – Basics of Income Tax

TDS on Salary

TDS, or Tax Deducted at Source, is a monthly deduction from your salary managed by your employer on behalf of the income tax department. This deduction is a pre‐payment of your annual income tax and is determined based on your yearly salary and tax‐saving investments.

For salaried individuals, TDS is a significant part of their overall income tax payment. You receive a TDS certificate, Form 16, around June or July, summarizing the monthly deductions made by your employer. Understanding TDS is crucial for managing your tax responsibilities.

Form 16

Understanding tax‐related documents is crucial for smooth financial navigation. Form 16, a TDS certificate, is a key player. Employers, as per income tax regulations, deduct TDS and deposit it with the government.

Form 16 holds two parts: Part A, detailing employer and employee particulars, and Part B, offering a breakdown of salary, other incomes, deductions, and tax payable. Remarkably, Form 16 is your one‐stop tool for e‐filing your income tax returns.

Form 26AS

Another essential document is Form 26AS, a summary provided by the Income Tax Department. It consolidates information on taxes deducted and paid, serving as a comprehensive record. This form, accessible through the IT Department’s website, unveils details about tax deductions made by deductors, tax deposits, and received tax refunds. Stay informed, as these documents are your allies in mastering your tax landscape.

Deductions

To cut down on taxes, seize every applicable deduction. Section 80C offers a significant Rs 1.5 lakh reduction in your gross income. Explore other valuable deductions under Section 80, like 80D, 80E, 80GG, 80U, tailored to various expenses and investments. Master the art of claiming deductions to optimize your tax‐saving game.

FAQs on Salary, Tax, and Allowances

1. Does salary include pension?

Yes, pension is part of salary but taxed differently based on its source.

2. What are allowances? Are they taxable?

Allowances are part of salary. Some are taxable, while others may be exempt.

3. What are perquisites, and how are they taxed?

Perquisites are additional benefits for employees. Taxability depends on the nature of the benefit.

4. Form 16 issuance without TDS deduction?

Not mandatory. Employers can issue a salary statement if no taxes are deducted.

5. Tax on arrears of salary?

Yes, arrears of salary are taxable, with relief available under Section 89.

6. Setting off losses against salary income?

House property losses can be set off, but business losses cannot be set off against salary income.

7. Claiming basic exemption for each employer?

No, the basic exemption applies to the overall income for the year, not separately for each employer.

8. Income tax on salary not subject to TDS?

If taxable, pay Self Assessment Tax even if TDS is not deducted by employers.

9. Can HRA be claimed if renting from spouse?

Not recommended. Such arrangements may be viewed as tax evasion and go against tax laws.